Wickes enjoyed an excellent 2021 with revenue for the 53 weeks to 1 January 2022 was £1534.9m, an increase of 14.0% on the prior year.

- Core sales increased by 15.1% to £1234.7m, with DIFM up by 9.4% to £300.2m.

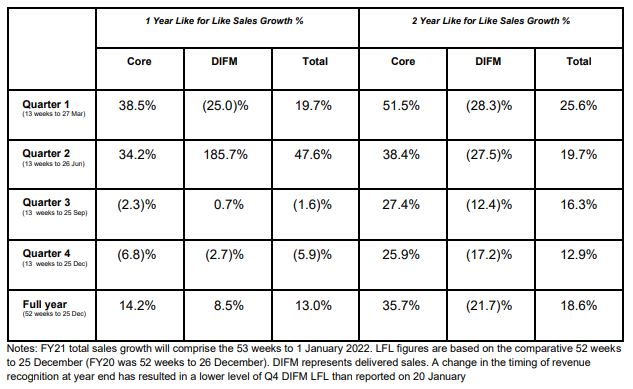

- Excluding the impact of the 53rd week and a modest reduction in space, comparable period like for like (LFL) sales increased by 13.0%.

Wickes Group plc - Full Year Results 2021Highlights

- Further market share gains in Core, supported by range development, enhanced service proposition and strong digital performance

- Strengthened Trade position with over 80,000 new TradePro customers, taking the base to over 630,000

- Resilient performance in DIFM despite Covid disruption, supported by virtual customer journey and new ranges

- Like-for-like sales* up 13.0% on 2020 and 18.6% on 2019

- Adjusted profit before tax increased to £85.0m** (2020 £49.5m)

- Reported profit before tax increased to £65.4m (2020 £28.9m)

Core Revenue

- Core LFL revenue grew by 14.2% for the full year and 35.7% on a two-year basis, with growth delivered across a broad range of categories supported by both DIY and local trade customers.

- In the first half, LFL of 36.2% was driven by strong DIY and local trade transaction growth.

- In the second half, LFL declined by -4.4% against tougher comparatives from the prior year, with the two-year growth remaining strong at 26.7% and holding up well into the fourth quarter.

- Second half performance was notably supported by buoyant local trade activity

Do it For me (Kitchen, Bathroom, etc)

- Within DIFM both the ordered and delivered sales profile was variable, reflecting the impact of Covid lockdown and supply chain disruption on the current and prior years. Orders were affected in the first part of 2021, with showrooms closed through to mid April

- Customer interaction was supported by our newly developed virtual showroom journey, however, this could not fully compensate for showroom closures.

- Orders recovered well in Q2 against weak comparatives and the year finished strongly.

- Delivered DIFM LFL revenue grew by 8.5% for the full year.

- Bathroom sales were particularly buoyant following a full range change towards the end of 2020 and installation participation continues to expand.

- Performance in the second half was impacted by supply chain challenges, including shortages of materials and project completion delays. Much of this was linked to self-isolation among supplier workforces, installers and customers.

- Lead times extended from an average of 6-8 weeks to more than double in certain periods and locations. As a result, the carry forward order book was more than double that of two years ago at well over £100m.

Price Inflation

- Commodity cost inflation accelerated into the second half and cash cost increases were passed on to customers over the period

- Retail price inflation for the full year was around 7%

Strategic Highlights

- Significant outperformance, growing at over twice the rate of the market

- Accelerating the store refit programme, now expected to be completed within five years, with 12-15 stores refitted p.a.

- New store opportunities identified with potential for up to 20 new stores over the next 5 years

Current Trading and Outlook

- Trading in the first 11 weeks is in line with last year against strong 2021 comparatives,

- Core sales are down 6.7% year on year and 26.3% ahead YO2Y, notably driven by demand from local trade with trade customer order books at record levels

- DIFM has had a positive start to the year. The order pipeline has continued to build strongly through winter sale

- Significant carried forward order book, double that of a year ago, provides confidence that delivered sales will be ahead of 2019

Wickes Sales by Quarter